Debt and liquidity summary

Access the most recent key data on our debt and liquidity situation.

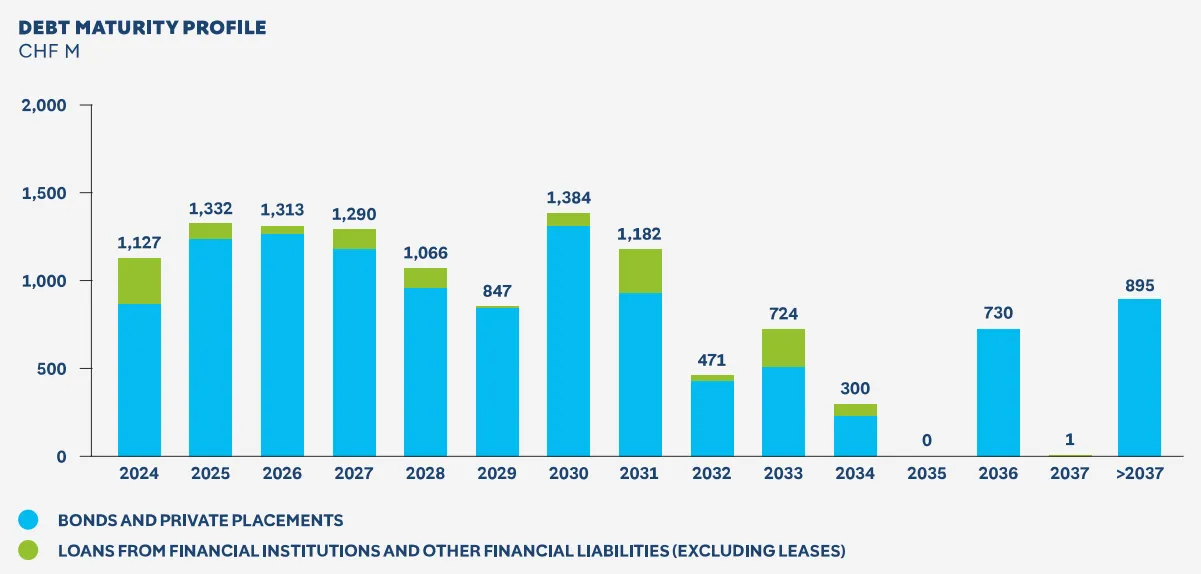

Gross financial debt overview as at 31.12.20231

- Liquidity2: CHF 11 bn

- Average debt maturity: 6 years

- Average nominal interest rate: 3.2%

1 Excluding operating and finance leases

2 Cash and cash equivalents + unused committed credit lines (no financial covenant at corporate level)