THE STRENGTH OF HOLCIM:

Why invest in us?

Holcim’s industry-leading earnings profile and record results position it to capitalize on growing demand and create stakeholder value.

ATTRACTIVE MARKETS

Accelerating growth in mature markets with our range of advanced building solutions.

HIGH-VALUE SOLUTIONS

Our portfolio of innovative and sustainable building solutions is driving profitable growth.

SHAREHOLDER VALUE

We deliver above-market returns and shareholder value with profitable growth.

SUPERIOR EARNINGS PROFILE

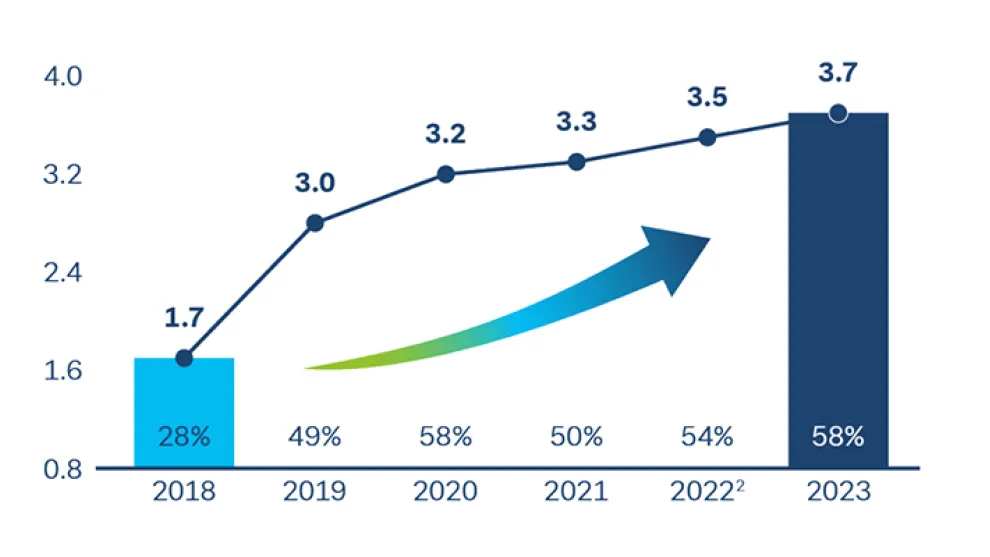

We have the strongest earnings profile in our sector with industry-leading margins and Free Cash Flow generation.

LEADER IN SUSTAINABILITY

With sustainability at the core of our strategy, we offer advanced low-carbon, circular and energy-efficient solutions for a net-zero future.

EMPOWERED LEADERSHIP

Holcim’s superior performance is driven by empowered leadership with a strong performance culture.

1 Mature markets comprise North America, Europe and Oceania (Australia & New Zealand)

2 2023 Scope 1 + Scope 2 CO2 emissions per million of net sales compared to 2022

3 Mature markets comprise North America, Europe and Oceania (Australia & New Zealand)

4 Before resolution with U.S. Department of Justice (DOJ)

5 2023 Scope 1 + Scope 2 CO2 emissions per million of net sales compared to 2022